How Long Is Boat Financing

This is the total out-of-pocket amount you are paying toward your purchase. Average Length of Boat Loans While you can technically obtain a boat loan anywhere from 12 months to 20 years depending on the lenderthe average boat loan is between 2-15 years.

How Long Can You Finance A Boat For

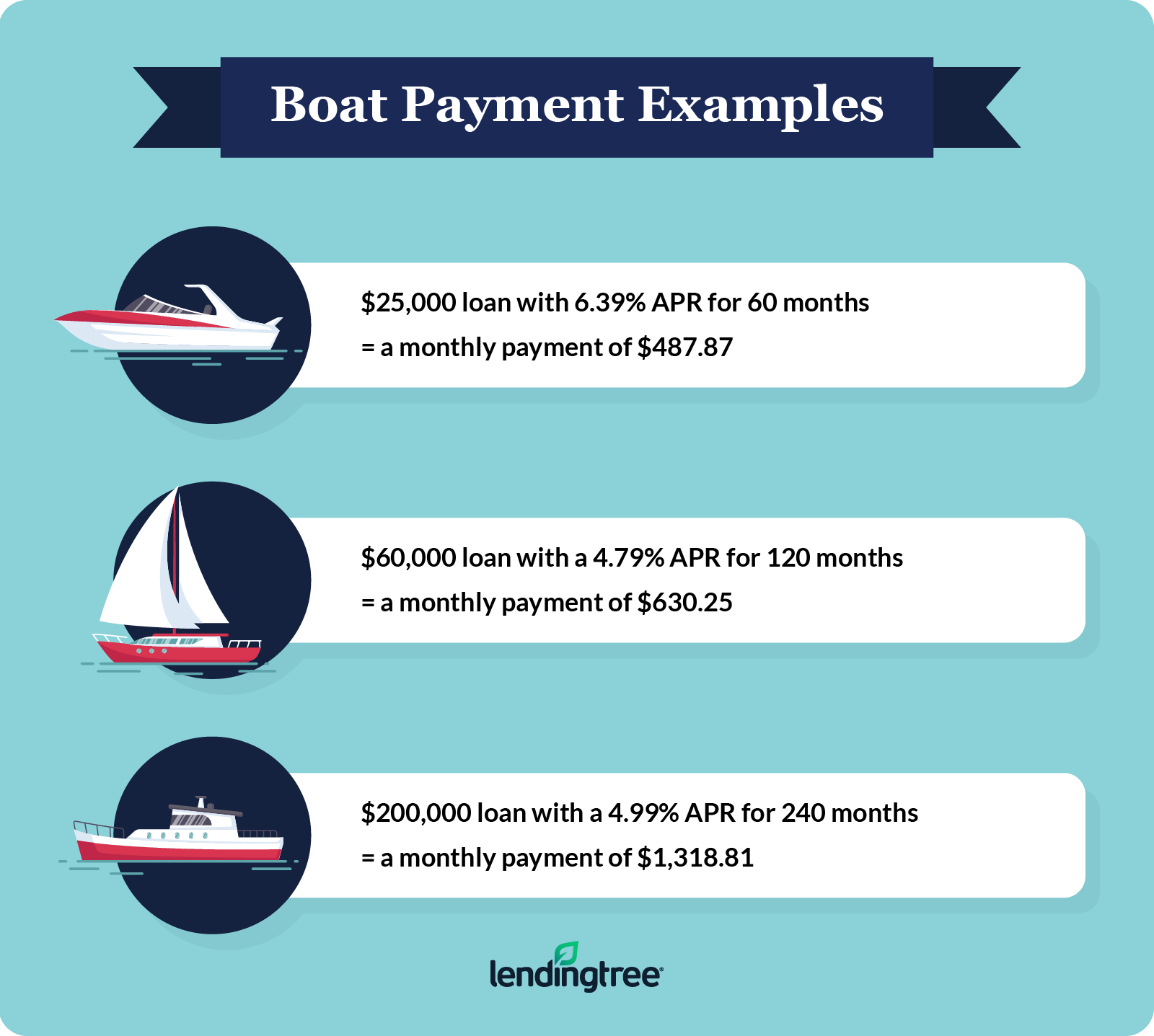

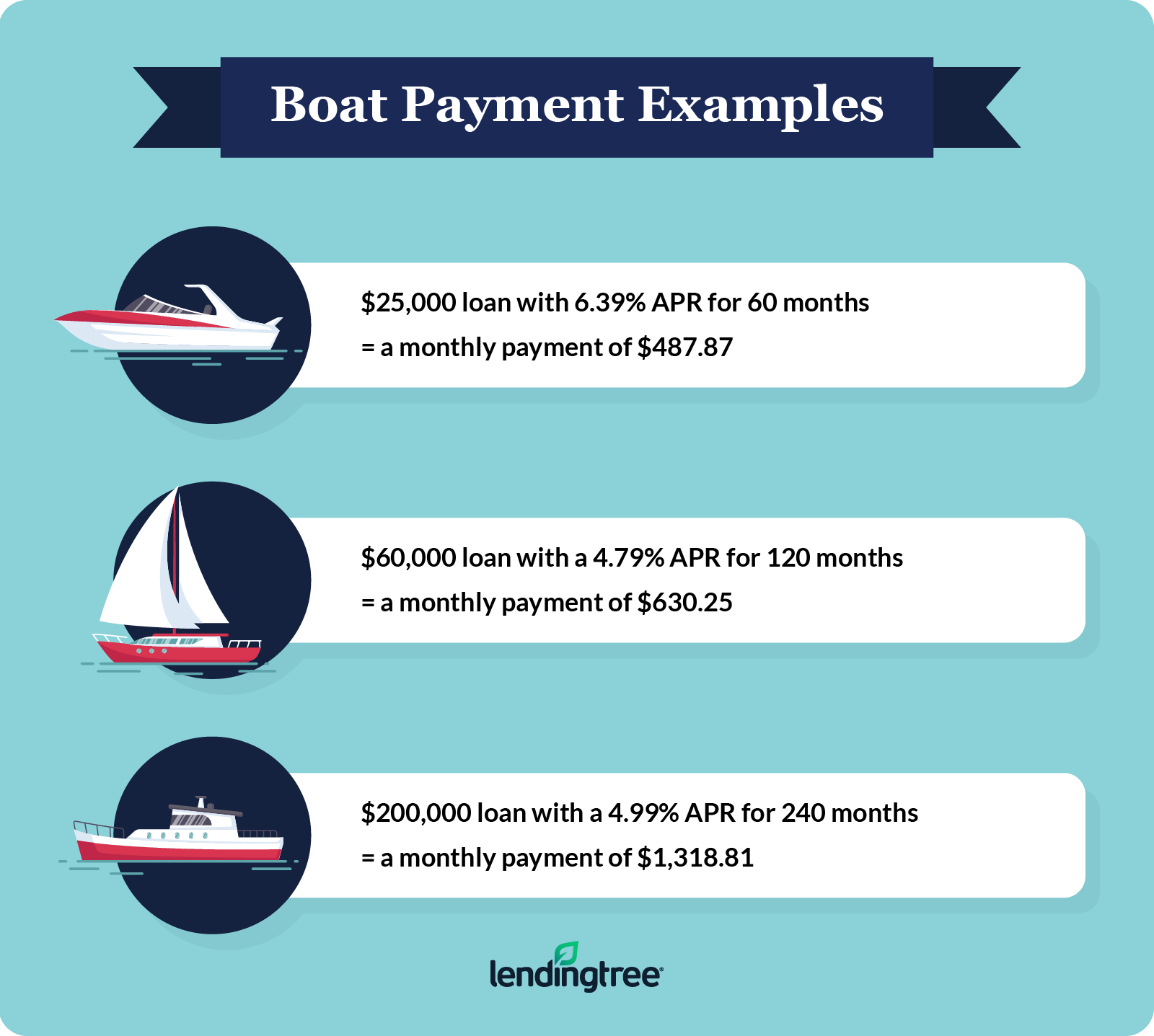

Starting boat loan rates can be as low as 429 APR and go up to 1189 APR depending on the amount and the loan term.

How long is boat financing

. Most car loans have a 36-month limit - within three years your loan must be paid off. Use our Boat Loan Calculator. If you know your monthly budget amount enter it in the total loan amount window and work backwards to determine what size loan you can afford.An average loan term is going to range from eight to 12 years and a long loan term is going to be 12 to 15 years. Boating may be more affordable than you think. Standard down payment is 15 but depending on your boat age loan amount and loan term the required down payment can be between 10 - 30.

Winning our pick for the best high-value boat loans is SunTrust which offers financing up to 4 million for as long as 240 months with interest rates starting at only 474 APR. Most Boat loans are for 15 or 20 years. Boat loans are different than car loans and they can actually last up to 20 years which is more similar to a home mortgage than anything.

How long can you finance a used boat. Longer terms mean Lower Payments but also more total interest paid. In most cases the loan term ranges from four to 20 years with higher loan amounts being stretched over a longer period of time.

This is the total amount you have already paid toward your down payment. Bank provides loans of up to 150000 for new or used boats as well as refinancing. Dealers are happy to assist in this regard because they dont want to lose the sale and on top of that many depend on financing as a profit center.

Work with your boat dealer Most dealers are thoroughly experienced at setting up financing and as long as your credit is good can often line up a competitive rate. Something to keep in mind though is that the longer the term of the loan the longer it. Yes they do usually get a cut.

Interest on a boat loan may be deductible if the boat has a galley berth and head. You can use our Boat Loan Calculator to figure out exactly how the monthly payments would differ between a 10-year term and a 20-year boat loan. A short loan term for boat financing is going to be anything under 60 months thats five years.

Longer terms mean lower monthly payments for any given purchase price. Boat loan terms are usually 15 to 20 years. What is the average interest rate for a boat loan.

Factors that Effect Boat Financing Terms. How long is the typical Boat loan. In some instances you can buy a brand new boat for around 250 a month while a new PWC may be purchased for around 125 a month.

Different lenders cater for different sizes of loan and the larger the amount of funds provided the more flexible the terms will be. Options include choosing a shorter financing term with a higher payment while others may choose a longer term with lower payments. On the other hand some differences between car loan and boat loan financing may work in your favor.

But a boat loan can be as short as two years 24 months. Mountain America offers flexible financing for new or used boat loans and refinancing. However it may not be in your best interest to borrow for that amount of time.

That depends upon the amount and type of loan as well as other factors. Because Marine Lenders extend longer terms on Boat loans than local Banks and Credit Unions your monthly payments are likely to be much lower than you expected. The short answer to Is it hard to get a boat loan is no.

Other financing sources. Boat financing terms generally range between 10 to 15 years. In some instances you can buy a brand new boat for around 250 a month while a new personal watercraft PWC may be purchased for around 125 a month.

Higher loan amounts often equate to longer boat loan terms. Many lender will even offer same day financing if you have great credit and you could be hitting the water sooner than you thought possible However banks are a little bit more strict when it comes to buying boats particularly used boats so here are a few things to consider. Obviously that can bring down your monthly payments quite a bit.

How Long Can You Finance a Boat. Its perfectly normal and honestly quite common to have a boat loan term stretched out over 120 months 10 years. It is of course always possible to borrow the money and secure the loan on assets other than the yacht but this would negate most of the specific benefits of financing.

To qualify for the banks best rate youll need to finance a new boat with a loan greater than 25000 no more than 100 of the boats value and a term of 48 months or less. Boat loans unlike home loans are typically going to be less than 100000 which means the payoff period will be shorter than say a 30 year mortgage. Typically lenders will reserve the longer terms of 180 or 240 months for boat loans of 25000 or more.

However some boat loans have a much longer term - depending on the amount you are seeking you may be able to stretch your terms to seven ten. Today many lenders will finance a boat for 20 years. In fact in todays market it has never been easier to obtain a boat loan.

Boat Financing How To Finance A Boat Lendingtree

Cruiser Boats For Sale Moreboats Com In 2021 Cruiser Boat Boats For Sale Boat

How To Finance A Boat Boat Loan Basics On The Water

Boat Financing 5 Options You Need To Know About Boats Com

Boat Loans How Boat Financing Works Credit Karma

2020 Mastercraft X24 Boat Financing Mastercraft Boat Mastercraft X24

Post a Comment for "How Long Is Boat Financing"